Prudential WealthGuardTM

Multi-Year Guaranteed Annuity

Help protect your life's work with predictable, guaranteed growth over time. WealthGuard offers both.

Annuities are issued by Pruco Life Insurance Company, Newark, NJ (main office). Pruco Life Insurance Company, a Prudential Financial company, is solely responsible for its own financial condition and contractual obligations.

What you need to know about WealthGuard:

- You choose an Initial Guaranteed Period that works best for you—terms of 3, 5, or 7 years.*

- The Initial Guaranteed Rate is a predetermined rate of return that provides compounded and predictable growth over the initial term.

- Your Account Value is protected from loss no matter what the markets do.

- WealthGuard provides tax-deferred growth which helps keep your money working for you before you have to pay taxes. There is no additional tax deferral for qualified contracts.

- If a need arises, you will have access to a portion of your Account Value.1

- There are no explicit product fees or expenses.

- For complete product information, please reference the client brochure PDF opens in a new window and the fact card. PDF opens in a new window

Footenote:

* Please note that each term may not be available in all broker-dealers and/or states.

Here’s how WealthGuard works:

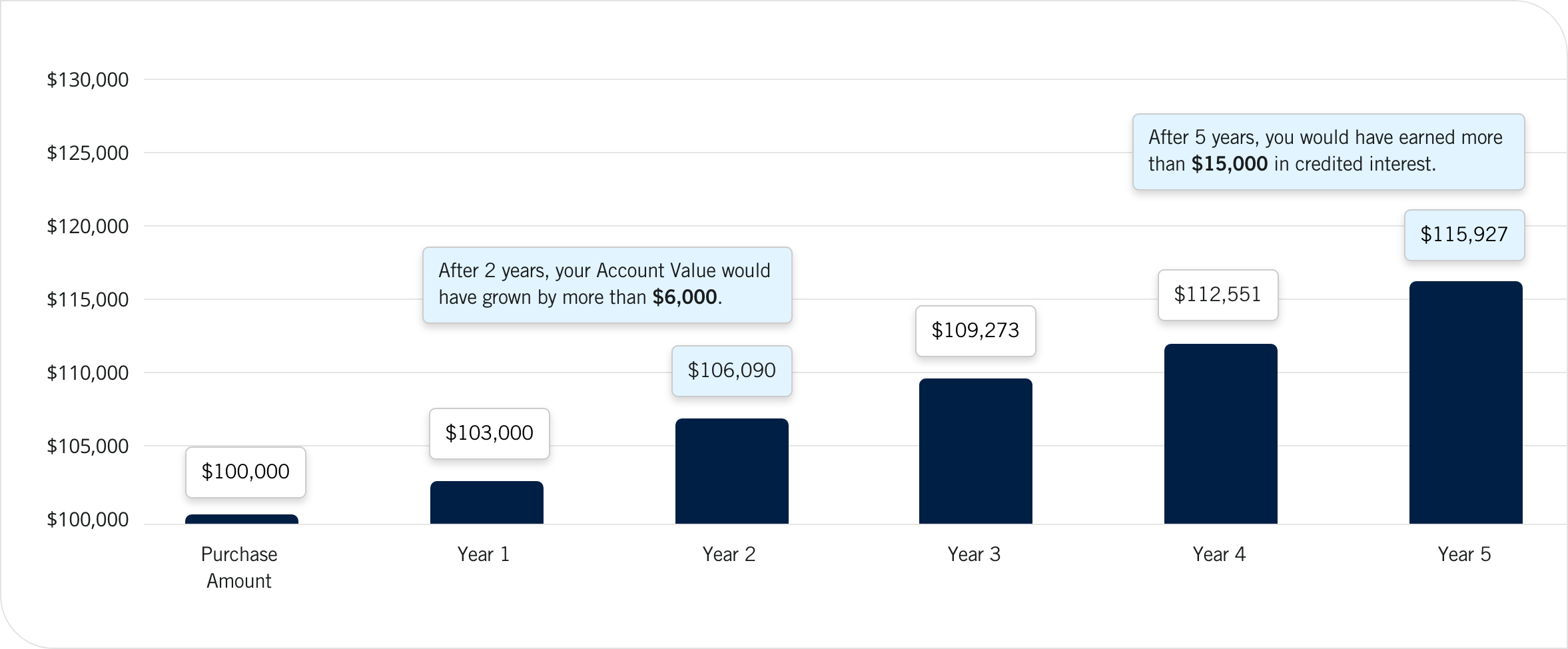

In this hypothetical example, we show the growth of an initial annuity net contribution of $100,000 with a 3% compounded annual rate for a 5-year Initial Guaranteed Rate Period with no withdrawals taken. At the end of year 5, you would have been credited more than $15,000.

This chart shows how WealthGuard can grow over time. On the extreme left of the chart, we see an axis that shows money amounts of $100,000 to $130,000, in $5,000 increments. Along the bottom of the chart is the axis that shows the years of the contract starting at the initial purchase date and going to contract year 5, in one-year increments. The chart has dark, vertical bars at each year that represent how much money the account is worth at the end of a contract year. Starting with the initial purchase, the chart shows that the contract starts with $100,000 and it is represented by a dark bar at the $100,000 mark. Moving to the right, at year 1, the account has grown to $103,000. Moving right to year 2, the account is now worth $106,090. There is a call out above the dark, vertical bar that says: After 2 years, your Account Value would have grown by more than $6,000. Continuing to the right to year 3, the account has grown to $109, 273. Moving right to year 4, the account is worth $112,551. There is a call out above the dark, vertical bar that says: After 4 years, you would have earned more than $15,000 in credited interest. As we move right to year 5, the chart shows that the account has grown to $115,927. There is a call out above the bar that says, after 5 years, your Account Value would have grown by more than $15,000.

Information about renewal rates

Compared to your rates at contract issue, renewal rates may be higher, the same, or lower.

Renewal rates are impacted by changes in various economic factors and may be higher or lower than the initial rates, but never be less than the Guaranteed Minimum Interest Rate. The Guaranteed Minimum Interest Rate is set at issue and applies for the life of the contract. The Initial Guaranteed Rate, and subsequent renewal rates, will not be less than the Guaranteed Minimum Interest Rate. Please speak with your financial professional for more information.

A financial professional can help you with everything from navigating Social Security to creating financial strategies for successfully funding a retirement that lasts 30 years or more.

FAQs: WealthGuard and Multi-Year Guaranteed Annuities

Looking for quick answers to some common fixed annuities questions? You’ve come to the right place.

A fixed annuity that provides a predetermined and contractually guaranteed interest rate for a specified period of time.

When the time comes for you to use the benefits that are offered by an annuity, it is important to remember that all guarantees are backed by the claims-paying ability of the issuing insurance company. Those payments and the responsibility to make them are not the obligations of the third-party agency from which the annuity is purchased or any of its affiliates, and none make any representations or guarantees regarding the claims-paying ability of the issuer.

Your financial professional can help you determine if an annuity is suitable for you. Prudential and its distributors and representatives do not provide tax, accounting, or legal advice. Please consult your own attorney or accountant when making important investment decisions. Prudential does not provide investment advice. The selections you choose together with your financial professional are all dependent on your investment goals and your risk tolerance.

You will have access to a Free Withdrawal Amount in each contract year. The Free Withdrawal Amount is equal to:

- First contract year: 10% of total purchase payment

- After the first contract year: 10% of prior year anniversary Account Value (after all interest has been calculated)

If you need to take more than your Free Withdrawal Amount during your term, surrender charges and a Market Value Adjustment (MVA) will apply to any amount in excess of your Free Withdrawal Amount. (See Important Information Disclosure Statement PDF opens in a new window for additional information about MVAs.)

- 3-Year: 7%, 7%, 7%

- 5-Year: 7%, 7%, 7%, 6%, 5%

- 7-Year: 7%, 7%, 7%, 6%, 5%, 4%, 3%

May vary by state and/or broker-dealer.

If you need to withdraw money to satisfy Required Minimum Distributions (RMDs) calculated by Prudential and related to your contract, you will not have to pay any surrender charges and the Market Value Adjustment will not apply.

One of the advantages of WealthGuard is that there are no annual contract or administrative fees. However, if you withdraw more than the Free Withdrawal Amount during the surrender charge period, surrender charges and a Market Value Adjustment may apply.

At the time you purchase your contract, you will have a 3, 5, or 7-year surrender charge period, which is the amount of time you must wait until you can withdraw funds from your annuity without facing a penalty charge. During this period, if you withdraw any or all of the money from your annuity, surrender charges and a Market Value Adjustment (MVA) will apply.

At the end of the guaranteed period, the Account Value will automatically renew into a 1-year guaranteed period.

- The interest rate will renew for a 1-year guaranteed period at no less than the Guaranteed Minimum Interest Rate outlined in the contract.

- Surrender Charges and MVA do not apply for the 1-year period.

In addition to the renewal option outlined above, you will also have the option to request a withdrawal, surrender or to annuitize.*

Footnotes

* The process by which you direct us to apply the Account Value to one of the available annuity options to begin making periodic payments to you. If you elect to receive annuity payments, you convert your Account Value into a stream of future payments. Please see the Important Information Disclosure Statement for additional information.

Footnote

1 Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 59½, may be subject to a 10% additional tax. Withdrawals reduce the Account Value. Withdrawals taken during the surrender charge period, excluding any Required Minimum Distributions (RMDs) calculated by Prudential, will be subject to any applicable surrender charges and a Market Value Adjustment (MVA).

Disclosure

INVESTMENT AND INSURANCE PRODUCTS ARE:

|

All products and/or options may not be available in all states or with all broker-dealers.

Annuities are issued by Pruco Life Insurance Company, Newark, NJ (main office).

Pruco Life Insurance Company is a Prudential Financial Company and is solely responsible for its own financial condition and contractual obligations.

Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your licensed financial professional can provide you with complete details.

Your needs and suitability of annuity products and benefits should be carefully considered before investing.

CDs are FDIC-insured up to $250,000 per financial institution, and there may be a penalty for early withdrawal. Fixed indexed annuities are not FDIC-insured and have limitations and surrender charges.

This material may not be approved in all states.

This web page is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing your retirement savings. If you would like information about your particular investment needs, please contact a financial professional.

Issued on the following contracts:

Contract: ICC23-MYGA(4/23), MYGA(4/23) or state variation

Endorsements: ICC21-P-FIA-MVA(10/21), P-FIA-MVA(10/21) or state variation

Schedules: ICC23-MYGA-MVA-SCH(4/23), MYGA-MVA-SCH(4/23) or state variation

For compliance use only: 1070332-6

For compliance use only: 1070332-00006-00

For Compliance Use Only: